Today’s first-time buyers may be forgiven for thinking that mortgage applications and conveyancing processes are archaic and slow. This new generation of mortgage applicants are accustomed to speedy transactions, but it can still take two to four weeks for a mortgage offer to come through, according to the Home Owners Alliance and the conveyancing process can be anything from six weeks to six months.

Mortgage applications: Increased regulation vs desire for speed

As the demand grows to speed up transactions, so the regulators introduce new measures to combat fraud and protect personal data, resulting in a drive towards the use of technology to streamline processes and reduce risk.

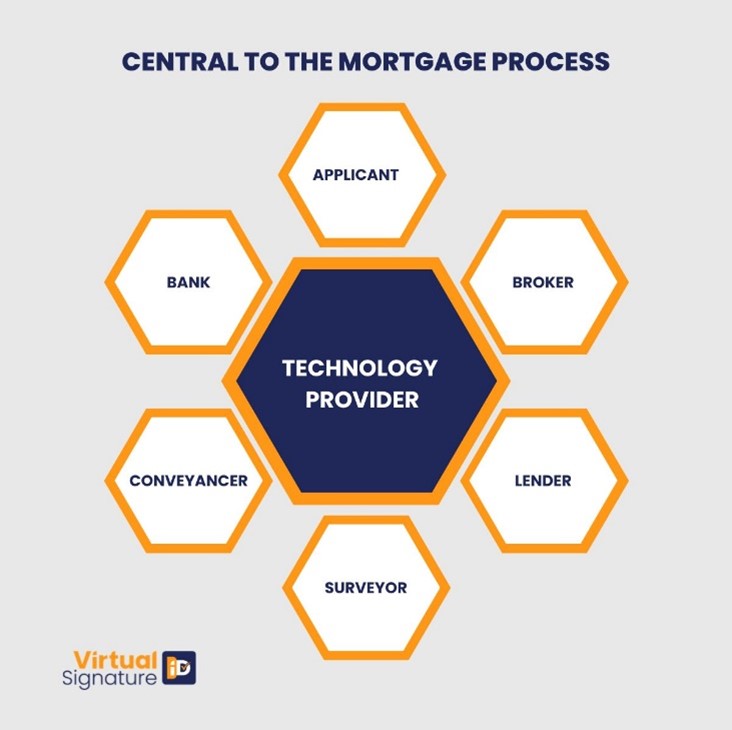

Looking at the mortgage application itself there are a number of ways where it can become more efficient with the use of technology and ultimately benefit lenders, brokers and applicants alike. A solution that enables all the key elements of the application to be carried out in one place makes the process less disjointed, as it consolidates the various functions of document signing, ID verification, witnessing, form filling and communication between the interested parties.

Automated forms

A dynamic HTML fillable form that is optimised for use on mobile devices can help borrowers to complete forms such as the Property Information Form remotely, in the comfort of their own home or on the move and sign and submit them to their broker or lender along with any attachments without the need for printing, scanning or posting.

Land registry forms, such as TR1 can be completed by conveyancers, eWitnessed and submitted to HMLR direct. With a technology provider connecting directly to HMLR’s systems, the forms can be pre-checked for errors, significantly reducing delays in registering deeds. HM Land Registry completed over 1,730,760 applications to change or query the Land Register in September alone, so this is game-changing.

Pre-qualification

The data entered by an applicant on a form can be checked for errors and the relevant information transferred directly to the lender’s case management system (CMS), with the broker having access to the pertinent information. Surveyors can be instructed with a digital form that has been populated with the appropriate data from that CMS.

The underwriting process can also be streamlined with a solution that allows various departments to sign or authorise documents in sequence before being returned to a lead underwriter for final sign-off.

ID Verification

At the outset, either the estate agent, mortgage broker, IFA or lender can verify beyond doubt who the applicant is. By using Near Field Communications (NFC), 3D video liveness, geo-location and anti-spoof technology, the applicant can carry out and submit an ID verification in minutes by taking a selfie, scanning their photo ID document and, where required, scanning the chip in their ePassport using their smart phone.

Supporting documentation

Open banking functionality not only allows the applicant to instruct their bank to supply the necessary bank statements to the lender, it helps with Anti Money Laundering (AML) checks by reporting on any unusual or suspicious financial activity.

Communication

Alerts, text messages and emails can be configured to send reminders and notifications to all parties involved.

Third party collaboration

By allowing those involved in the matter to share relevant information and have access to specific documents, a huge amount of time and repetition of tasks can be achieved. The broker, lender, estate agent, surveyor and conveyancer can all work together using the same system and the applicant only needs to provide the required information once. Applicant data such as email address and physical address can be verified using background screening technology then shared with the relevant third parties. Certified eSignatures can be re-verified at a later stage by keying in a unique identifier that appears on the document. In her recent blog for Mortgage Finance Gazette, “Duplication of Tasks is Wasting Time for Home Buyers”, Beth Rudolf, Director of Delivery at the Conveyancing Association (CA) stresses how important it is to use digital means to ease the unnecessary doubling up of work that causes delays in property transactions.

Compliance

With HMLR advocating “Safe Harbour Standards” in Practice Guide 81 which allows conveyancers to apply electronic signatures to Deeds under certain conditions, and encouraging the use of technology to help reduce fraud, accredited providers can give a high level of reassurance to professional services firms that they are remaining compliant whilst minimising risk.

Deploying technology to carry out KYC, AML and ID checks means that there is less risk of human error and with a full report being generated, areas of concern can be highlighted which can aid decision making and substantiate audit checks.

Ewitnessing: a game-changing breakthrough for the property sector

One element of the mortgage and home buying process that can cause delays is the need for applicants to have their signature witnessed on deeds and certain other documents. To date, this step has involved the witness being in the same room as the signer, even if attesting to an electronic signature. However, in cases where the eSignature provider is a UK Government approved Identity Service Provider (IDSP) and vetted by a Quality Service Trust Provider such as Globalsign to produce certified eSignatures, it can act as the witness because it is verifying the identity and location of the signer in real-time to such a high degree of confidence. HMLR confirms this in Notice 2 (under Rule 54c of the Land Registration Rules 2003) : documents in electronic form purporting to affect registrable dispositions effective 23rd April 2023. This was updated in September 2023. The result will be a game-changing breakthrough in the property sector, saving time and reducing the risk of mortgage fraud, which has increased by 32.8% in the last year according to FT Adviser’s September 6th Article. This method also saves the applicant having to repeat the identification process numerous times.

Customer satisfaction

Whilst consumers continue to enjoy transacting online, they also want reassurance that the platforms they are using are safe and secure. What could help to give them the confidence they need when sending the sensitive information required for a mortgage application? Integration into a lender or conveyancer’s existing case management system utilising their corporate branding is one example, meaning end users do not have to leave one platform and go into another for the ID check or eSignature process, for example.

VirtualSignature-ID is the digital onboarding expert that can help every step of the way during the mortgage application and conveyancing process. From our range of eSignature solutions that cater for all levels of risk to our SmartForms and SmartCheck ID verification tools we have a fully integrated solution that pulls all the various elements together, speeding up the process to the satisfaction of all parties.