With identity fraud rapidly rising, it is more important than ever to ensure that your clients are who they claim to be. In this article, David Kern, CEO and technology innovator at VirtualSignature-ID, provides some useful tips on how firms can significantly reduce fraud by being smart about the ID verification and fraud detection technology they adopt.

Tip #1: Make use of more advanced technology to eliminate deep fake ID

A huge amount of biometric fraud is perpetrated using data that is readily available and accessible to criminals. For example, images on LinkedIn or Facebook can be easily used to create a fake ID. More sophisticated fraud teams and criminals can also create really convincing and realistic deepfake videos.

Use of biometrics such as 2D photo and digital images on their own are therefore useless without very good anti-spoofing technology. One of the most effective forms of this is Liveness Detection. You can’t really be sure that the facial ID sample is from the original owner if the biometric isn’t paired with best-in-class Liveness Detection. So, the choice of technology used for biometric identification is really important to eliminate deep fake ID. VirtualSignature-ID, for example, uses the most advanced AI powered 3D-Level Liveness Detection to eliminate deep fake ID whilst also ensuring that the technology meets international standards and is compliant.

Tip #2: Adopt higher levels of ID Qualification checks as standard

The most sophisticated and secure way currently available on the market is to verify identity by electronically examining a government-issued e-passport or chip-based ID card which has the critical information stored on the chip in the document. This higher level of ID Verification uses Near Field Communication (NFC) technology, which is built into smart phones, to extract data from the chip and cross verify this with the information obtained from the Machine Readable Zone (MRZ) data on the photo ID page of the e-document being checked. In-depth chip authentication using Public Key Infrastructure (PKI), together with a specially designed ID validation app, is used to authenticate the data encrypted in the chip, which makes it spoof-proof for even the most advanced fraudsters. A valid certificate is then normally issued to confirm proof of ID.

Where firms do not require the higher standard that uses biometric and NFC verified identity checks, they should still opt to use Optical Character Recognition (OCR) technology which reads and matches the data in the MRZ on the passport or drivers licence coupled with some form of facial recognition.

Tip #3: Conduct identity and fraud checks that align with the level of risk

Firms far too often adopt a ‘one size fits all’ approach. Matching the right level of identity verification and fraud checks with the appropriate level of risk for a matter or transaction just makes sense.

For example, in a conveyancing transaction, if a firm wishes to achieve ‘Safe Harbour’ status with HM Land Registry, they would need to follow the higher standard of checks where more advanced technology using biometric and NFC verified identity checks is used. Whereas for a Claims transaction, a lower level check with biometric and ID verification using OCR technology as mentioned above, may be more appropriate.

Solutions that enable businesses to mix and match the different levels of checks on a single platform across the firm, or for certain practice areas, or even for specific matters, are currently available and firms should be smart about how they select, adopt and use such technology to their benefit rather than adopt a ‘one size fits all’ approach.

Tip #4: Mitigate Risk by undertaking broader checks and data points

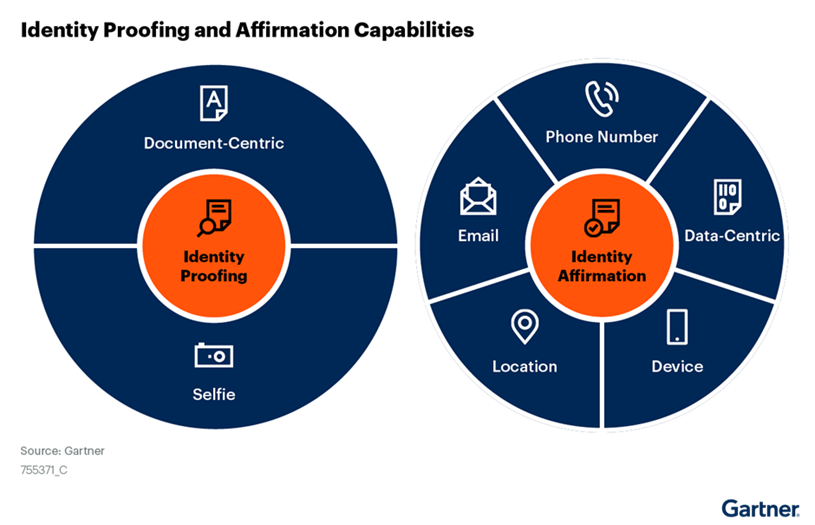

Whilst ID checks using facial recognition and identity documents are a critical component and valuable in fighting fraud, it is important to NOT have a bias by only relying on these. By using the right technology, firms should be able to undertake multiple checks that together provide layers of verification and a higher level of affirmation that the person is who they say they are. These checks would include other dynamic and contextual data points such as: geo-location to see if they are in the country, phone number checks, email address checks, IP address checks, device ID verification, proof of address checks and multiple bank checks. Combining the validation of these elements to create an overall risk profile provides a higher level of confidence that the risk of fraud has been minimised.

Tip #5: Understand the data behind the checks

A surprisingly large amount of firms select and adopt solutions without really understanding the level and quality of data being checked. They are complacent in accepting marketing blurb and the simple ‘pass’ or ‘fail’ results delivered, without fully understanding the meaning and level of quality of the data checks behind the results.

However, not all ID verification and fraud detection solutions are the same. The type and level of quality of the data checks undertaken to arrive at a ‘pass’ or ‘fail’ result can vary greatly. For example, for a ‘proof of address’ check, many solutions just check for the current address whereas the SmartCheck solution from VirtualSignature-ID automatically checks the past five year address history. Similarly, for a ‘Proof of Funds’ check, many applications simply return copies of bank statements while the SmartCheck Bank & Source of Funds check reviews the list of transactions and highlights any significant amounts or unusual activity, thereby reducing the time and effort required to verify and identify potential fraud.

Technology can do a lot of the heavy work of sifting through the data and firms would be well advised to seek solutions that undertake deeper analysis to further reduce the risk of fraud.

Tip #6: Make it easier for your clients and give them a trusted user journey

Clients today expect a seamless and flexible digital experience. However, many current solutions are laborious, time-consuming and difficult to use especially where the client is asked to provide an ID document and go through the ID verification process. It is critical that firms select and adopt solutions that are efficient and which deliver a high quality user experience. Otherwise clients are more likely to abandon the checks, resulting in manual intervention, higher risk and increased effort and cost.

Furthermore, it is important to remember that clients too want to feel secure in knowing who they are dealing with and that the ID verification process and checks are from the firm they have appointed. Too many existing solutions use technologies from different suppliers to do their checks and even transfer the user to other sites or companies during the process. This breaks the client’s confidence and trust in dealing with their chosen firm. Having one platform that is company branded and which can undertake all the checks required (ID Verification, AML, Source of Funds, Bank pay, etc.) in a simple and easy to use client journey is a must have for any professional practice. This helps to keep the client engaged directly and provides a higher degree of comfort.

In conclusion, implementing one or more of the above tips should help to significantly reduce the risk of fraud, improve client experience and save effort and cost. The good news is that the technology is available today and firms should check whether their existing solutions are robust enough and if not, make the switch to a better, longer term solution before they get left behind.

This blog first appeared as an article in Today’s Conveyancer Editor’s Pick on 24th August 2022.